Cash flow management is one of many reasons it’s so hard to get a new business off the ground.

New and growing businesses often don’t have a buffer of extra cash to get them through shortfalls, because they’re always reinvesting. Years with the most significant growth—including the first few years of a business’s lifespan—are also challenging when it comes to cash flow.

Improving cash flow is a smart move for any business. It doesn’t matter how great your business model is, how profitable you are, or how many investors you have lined up. If you’re looking for one area to focus on to make a dramatic impact on your business, this is it.

What is cash flow management?

Cash flow management is the process of monitoring, analyzing, and optimizing the inflow and outflow of cash within a business. It involves ensuring that a company has sufficient funds available to meet financial obligations, such as paying bills, salaries, and loan repayments.

Cash flow management is critical to maintaining your business’s financial well-being.

Cash inflow is the money coming to a business—this includes sales, interest earned on investments, and any credits paid to the company. Cash outflow is the money going out of a business. For example, expenses like website maintenance and hosting, inventory purchasing, rent, shipping fees, and more. A cash flow statement records these inflows and outflows so you can see it all at a glance and dive deeper where needed.

To calculate cash flow, a business notes how much cash is available at the beginning and end of a specific period, which may be a week or a month. The business will have a positive cash flow if there’s more in the account at the end of the period than when the period began; it will have a negative cash flow if there’s less cash at the end.

Getting good at cash flow management is one of the best things you can do for your business. Not only that, it’s a skill you can carry over into other ventures, as well as your personal finances.

The importance of cash flow management

1. Predict shortfalls

Effective cash flow management helps you identify any potential cash gaps and predict shortfalls before they happen. When you’re aware of potential issues, you can avoid crippling cash shortages that could shut down your business and take action before things spiral out of control.

Examples of actions you can take include:

- Calling your landlord and asking them to cash your check a few days later

- Delaying a shipment by a couple of weeks to put off paying duty at customs

- Running a promotion to drive additional sales quickly

- Going on a collection spree to clear up outstanding bills

2. Reduce stress

Believe it or not, managing cash flow will alleviate a lot of stress. Much of the anxiety entrepreneurs experience around paying bills comes from not knowing what’s going on and worrying about whether or not things will work out.

It’s much better to know what’s coming, even if the outlook isn’t good. When you know where you stand, you’ll feel prepared. More importantly, you’ll be equipped to deal with it.

3. Know when to grow

When you’re managing cash flow, you know exactly how much money you have to spend on growth. Remember, just because your P&L tells you there’s extra money lying around, doesn’t mean it will materialize in real life.

Similarly, just because you have $20,000 in the bank doesn’t mean you can spend it. You might need it to pay for upcoming expenses. When you look at your cash flow over weeks and months, you’ll know how much to keep on hand and how much you can stash away or spend on growth.

4. Gain leverage

Effective cash flow analysis gives you leverage. If you need to borrow money from the bank via a line of credit to get you through a shortfall, or want to get a supplier to give you a break for a few weeks without interrupting service, a good cash flow management system will back you up.

Financial institutions generally like to see this kind of planning, especially if you can clearly show when you’ll be able to repay the funds. Suppliers are much more likely to be flexible if you can tell them exactly how you’ll pay and when—rather than cutting communication like most businesses do during tough periods. These people want your business and will be more willing to work with you through the ups and downs if they can trust you.

5. Improve budget accuracy

Cash flow is significantly more accurate than a budget. Budgets tell you what you want to happen. They’re wishful thinking, and entrepreneurs are optimistic by nature. Cash flow projections tell you what is actually happening so you can deal with it—even if it’s not what you planned at the beginning of the year.

Business owners would often rather not think about managing cash flow and just hope it all works out. But it’s not worth the risk. It's beneficial to stay on top of your money incase your budget needs adjustments.

📚Read: Predicting Profitability: How to Do Break-Even Analysis [+Free Template]

10 cash flow management strategies

- Prepare a forecast

- Focus on inventory control

- Lease, don't buy

- Send out and pay invoices on time

- Look for alternative revenue streams

- Check if suppliers offer early pay discounts

- Negotiate supplier terms

- Open a high-interest savings account

- Have an emergency fund

- Invest in software

1. Prepare a forecast

Effective cash flow management in business starts with forecasting your cash inflows and outflows, timing, and projected cash balances.

Whether you use a spreadsheet or financial planning tool, make sure you account for all cash inflows and outflows, including salaries, receivables collections, rent, inventory purchases, investments, and loan payments. The more accurate your cash flow forecasting is, the better decisions you’ll make about spending, investment, and growth.

Let’s say you need to overhaul your store’s security system next month. It’s a large expense that could affect your ability to pay your bills. Implementing your cash flow forecast gives you enough time to plan and rein in that expense, so you’ll have enough cash flow to keep your business running.

The best way to keep control of your money is with cash flow statements. In small business cash management, a cash flow statement is an account of the cash flowing into and out of a business over an accounting period, such as a month, quarter, or year, although you can track cash flow for any time period that helps you see where your money is going. Try this out in Shopify’s cash flow calculator.

Most businesses work best by planning week to week. However, some may need to plan daily, while others only need to plan monthly. It’s also up to you if you want to include every single expense or just categories of expenses. These decisions will depend on the scale and complexity of your business.

Similarly, some businesses will be able to project their cash flow accurately for six months, while others will only be able to do so for two weeks. In general, try to project four to six weeks with reasonable accuracy. A good rule of thumb for small business cash flow management is the farther you look into the future, the less accurate your predictions will be.

2. Focus on inventory control

With cash flow management in mind, consider updating inventory to reflect current supply-and-demand levels in your business. Do a frequent ABC analysis of your products to determine what’s selling and what’s not. Then, you can keep more inventory on hand that’s likely to move fast and get rid of dead stock at a discount.

3. Lease, don’t buy

Small business finance is always tricky, especially during challenging times. You don’t want to get into much debt, but sometimes you need to invest in equipment or inventory that will pay off in the long run.

Good cash management practices would be to lease rather than buy. When you lease, you can make small payments over time and keep cash flow for your day-to-day operations. It’s also a business expense, so you can write it off on your taxes.

4. Send out and pay invoices on time

One key part of small business cash flow management is getting paid as soon as possible. If you send out invoices immediately, receivables will come in faster.

If you typically operate on a monthly billing cycle, talk with your vendors to let them know you’ll be moving to an invoice-on-demand model. Bonus points if you offer them an early pay discount.

💡 TIP: Use Shopify Bill Pay to easily view, upload, pre-schedule, and pay vendor invoices via credit, debit, or ACH transfer without paying subscription fees.

5. Look for alternative revenue streams

If your scenario is changing and putting pressure on your current revenue streams, look for alternative ways to make money online. You may be able to temporarily, or even permanently, replace less profitable revenue streams with easier, more effective ones.

For example, you can offer different shopping experiences like buy online, pickup in-store (BOPIS) and local delivery options. This can help make managing your cash flow easier and take pressure off your top line.

6. Check if suppliers offer early pay discounts

One way to preserve working capital and cash flow management is to pay suppliers less. Some suppliers may have early pay discounts you aren’t aware of. Paying your suppliers early can help you save cash and even improve the integrity of your supply relationships, especially if other vendors are delaying payments in abnormal business conditions.

7. Negotiate supplier terms

During tight times, contact the suppliers you have a strong history with and request more favorable terms, so you can manage cash flow effectively.

Many suppliers are happy to work out a flexible payment plan or offer a payment extension. The key is to establish strong, trusting relationships with them before your cash flow situation gets dire. Be honest, keep communication open, and pay on time.

If you have a history of paying early or on time, for example, your supplier may be willing to extend your payment, giving you more time to pay.

8. Open a high-interest savings account

Look at your income versus expenses. If there’s a surplus, think about saving it in a high-yield business savings account to maximize your cash flow. These accounts let you securely hold money you don’t intend to spend right away so your money starts to work for you.

When choosing a savings account, consider one that’s easily accessible, easy to use, and gives you more than 1% for leaving your cash in it, with a low minimum deposit. This can improve your cash position month by month and help you prepare for any unforeseen impacts on your customers or suppliers.

9. Have an emergency fund

Growing a business strains your cash flow. Prepare your business by establishing an emergency fund. It’s like a rainy-day cash reserve you set aside to cover operating expenses or debt obligations, economic downturns, or emergencies.

An emergency fund helps you weather unexpected challenges, especially during hard times, when growth opportunities come along, or when you need financial flexibility. It ensures cash is available when needed without negatively impacting your cash flow.

Three to six months of operating expenses is a good place to start, but review your financial obligations, your business, and your industry to determine how much you'll have to set aside.

10. Invest in software

There are more tools than ever available to assist you with effectively planning for your cash needs and help calm the chaos of cash flow management.

Accounting software can digitize your data entry, while automation platforms that integrate with your accounting and invoicing tools to track expenses in real time, automate financial reporting, and offer financial planning insights. If you identify issues with timely payments, for example, an accounts payable software, like QuickBooks, can make your payment process pain free, improve your cash flow, and enhance your reputation with suppliers and customers.

Artificial intelligence-enabled solutions are also available, which streamline business processes, like creating budgets and managing cash flow. For example, Panax, an AI-powered cash flow management platform, leverages open banking and generative AI algorithms to improve cash flow forecasts, automatically categorize transactions, and give users real-time access to cash flow details.

Cash flow management tools

From spreadsheets to dedicated financial management platforms, there are many options for cash flow management tools to help you get a better handle on your business.

Google Sheets

For some businesses, the free tool is the best one: Google Sheets. Anyone can use a Google spreadsheet to create cash flow statements. Although it’s a manual process, it doesn’t take long to set up, and it’s easy to track. More importantly, it’s easy to customize on the fly and adapt to your specific needs or situation. You can be as broad or as specific as you want. And the time you spend creating and updating your spreadsheet is valuable for gaining a clearer picture of your situation.

The cash flow spreadsheet is an outline of where your cash is going. It shows you when cash will be coming in and when it will be going out, and it’s a great way to visualize cash flow management and adjust your approach.

Tesorio

Tesorio offers advanced tools for cash flow management, like unified bank account reports, cash forecasting, reporting, and analytics, and collaborative features.

Its Total Cash Flow Dashboard integrates with your banking and accounting platforms to provide real-time insights into your cash flow. You can see everything about your past, present, and future cash flow performance. It also notes patterns and makes recommendations and forecasts based on live data integration from your bank, CRM, ERP, and other tools, so you can make decisions based on the latest numbers.

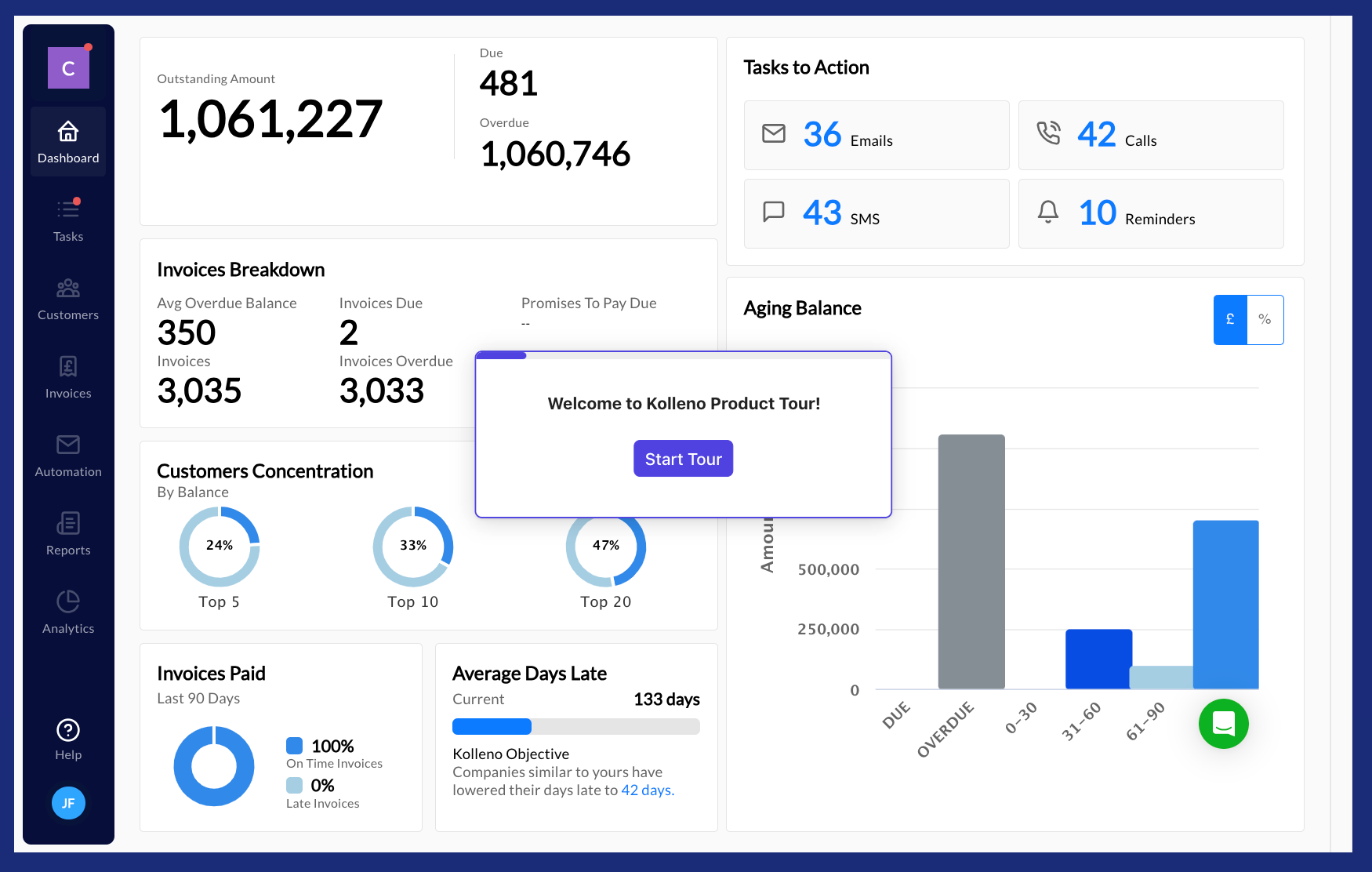

Kolleno

Kolleno offers features for cash flow management, accounts receivable (AR), and reconciliation. It will help you analyze current cash on hand and predict future cash flows, as well as automate for efficiency.

Jirav

Jirav is a comprehensive financial management platform with dedicated features to analyze and optimize cash flow. It specializes in integrating your cash flow analysis with the overall financial picture of your business.

It also includes customizable reports, intuitive dashboards, built-in cash key performance indicators (KPIs), and automation and integrations with many major platforms.

Causal

Causal is a dedicated financial modeling tool for businesses. It includes a long list of features that go beyond just cash flow management, including hiring plans, currency conversion and consolidation, and more. Causal also visualizes the data to make it easy to understand and share.

Cash flow management example

Suppose Neil runs a chain of grocery stores in Chicago. He runs into certain cash flow issues owing to an unexpected decline in revenues. In response, Neil makes strategic adjustments. First, he renegotiated payment terms with his suppliers, which extended his payables by 30 days.

Then, Neil set up alternative revenue streams beyond his core business, such as offering an in-store deli for customers to pick up ready-to-eat meals while shopping, setting up a Shopify store to take online orders, and partnering with local vendors and brands to provide exclusive products and delivery services. Neil also leveraged accounting software that provides actionable data and insights to optimize inventory management.

Within three months, Neil’s grocery chain saw a 30% rise in operating cash flows, which improved his company’s financial profile and guaranteed seamless operations. To cushion his businesses against similar unexpected contingencies, Neil established an emergency fund and opened a high-interest business savings account that improves his cash position month by month.

By implementing the right cash flow management strategies, you can overcome your business's financial hurdles and achieve sustainable growth.

Get your free cash flow management template

Most companies can’t survive without proper cash flow management. But with the right cash flow management strategies and tools anyone can do it. Take the time to get organized now and it’ll be easy to stay on top of it.

If you haven’t already, don’t forget to grab your free cash flow template.

Read more

- Free Business Plan Template- A Practical Framework for Creating Your Business Plan

- How to Start a Dropshipping Business- A Complete Playbook for 2024

- How to Write a Perfect Business Plan in 9 Steps

- Competitive Analysis Can Grow Revenue—Here’s How

- 25+ Ideas for Online Businesses To Start Now (2024)

- Bookkeeping 101- How to Keep Records for Your Small Business

- 6 Ways to Increase Ecommerce Profit Margins

- How to Price Your Products in 3 Simple Steps

- How to Prepare Your Store to Work With Big-Box Retailers

- Shipping Trends: How To Deliver on Your Customers’ Shipping Expectations

Cash flow management FAQ

What is a cash flow management plan?

A cash flow management plan is a comprehensive document that maps out how a business will monitor, analyze, and optimize its cash inflows and outflows, so it has sufficient funds to meet financial obligations.

What are the tasks of cash flow management?

- Forecasting: Prepare a cash flow forecast to anticipate cash inflows and outflows over a specific period.

- Monitoring: Develop and implement a consistent system of collecting timely payments from customers.

- Payment management: Schedule payments to ensure there’s enough cash to keep the business moving and maintain positive cash flow.

- Expense control: Stay on top of expenses and identify areas to reduce costs so they don’t outgrow revenue or drastically reduce profit margins.

- Analysis: Continually review your cash flow statement and compare actuals against forecasts to ensure an ongoing positive cash flow.

What is the difference between cash flow management and cash management?

Cash flow management involves monitoring, analyzing, and optimizing a business’s cash flows to keep it moving. It also deals with handling and investing a company’s funds to minimize liquidity issues and maximize returns.

What is the best way to manage cash flow?

There’s no single best way to manage cash flow. It requires a mix of strategies to keep the cash flowing. Here are some effective cash flow management strategies you can implement:

- Prepare a forecast of your cash inflows and outflows, timing, and projected cash balances.

- Update inventory to reflect current supply-and-demand levels in your business.

- Lease rather than buy equipment or inventory.

- Send out and pay invoices on time.

- Look for alternative revenue streams to take pressure off your top line.

- Check if suppliers offer early pay discounts.

- Negotiate for more favorable terms with suppliers.

- Put your money in a high-interest business savings account.

- Establish an emergency fund to weather unforeseen expenses and emergencies.

- Invest in software to assist you with effectively planning for and managing your cash.